Getting the lowest mortgage interest rate is one of the biggest factors when you buy a house for the first time or if you already own a home.

So, how do you get the lowest interest rate for your mortgage or refinanced mortgage?

We have put together 7 easy tips that will help both parties: First-time home buyers and current home owners.

Tip #1 – Increase credit score

Before you call or sit down with a mortgage lender, take some time to check out your credit score and credit report.

Whether you own a home already or you are looking to purchase a home for the first time, taking the time to increase your credit score will save you thousands over the life of your mortgage and decrease your mortgage interest rate.

We have an entire article on how to increase your credit score here, so we won’t go into details about it. But here are some of its key points:

- Credit Report – Pull your credit report. Either through (Experian, Equifax or TransUnion ). Review all of your accounts and take action on delinquent accounts.

- On-time payments – make sure that all of your accounts have at least 6 months of perfect payments

- Credit utilization – It’s good to have a variety of credit types like: auto loan and revolving accounts such as a store card (Home depot) and a credit card.

- Debt Ratio – On revolving accounts, its good to ensure that they are NOT maxed out. Having credit cards all under 10% utilization is best for increasing your credit score.

- Pay off small accounts – If you have some credit cards that are relatively small (under $1,000) then pay them off.

Increasing your credit score takes time and if your credit score isn’t where you want it to be to decrease your mortgage interest rate, that’s fine.

Here is an example chart from myFICO that shows how increasing your credit score directly affects the APR, Monthly Payment and Total Interest Paid:

Take time to work on your credit profile to put yourself in better position to purchase or refinance at a later time when your credit score aligns with the interest rate that you are wanting.

3 first-time home buyer tips for getting the lowest mortgage interest rates

- Automated Payments

Some banks will offer you decrease in your interest rate if you setup automated monthly payments for your mortgage. Not all banks will do this, but it doesn’t hurt to ask.

- One person on loan

Sometimes having two people on the loan will actually hurt your interest rate and actually keep you from getting a loan all together.

Because banks typically take the average of your three credit scores, if one person has an average credit score of 640, while the other has an average of 720, you may want to not have the person with a 640 on the loan.

That doesn’t mean that both can’t be on the title, but it may make sense to have only one on the loan to help decrease the interest rate.

Otherwise, if you have to have two people on the loan, take 6-9 months to increase the lower credit score before buying a home. Otherwise, you will end up having a higher interest rate on your mortgage; as shown in the interest rate chart above.

- Increase down payment

Increasing your down payment has two huge benefits.

One – it decreases your interest rate

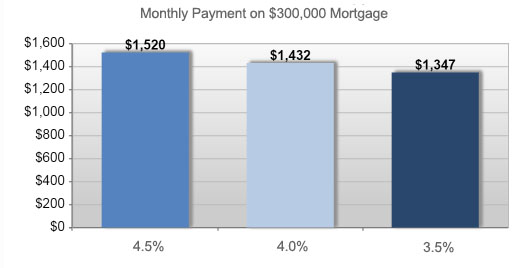

View the chart below that shows the affect of how lowering your interest rate affects your monthly payment for the life of the loan:

Interest rate affects monthly payment

Two – it decreases your monthly payment.

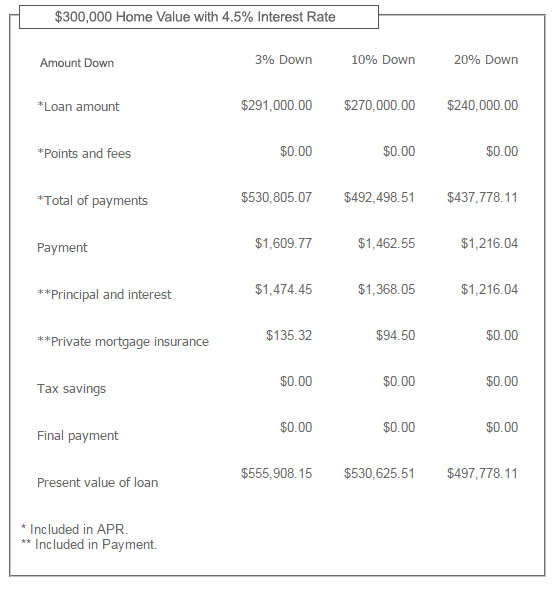

AND if you can put down 20%, you can actually save $150 – $200 PER MONTH without paying Private Mortgage Insurance (PMI).

View this chart that compares your monthly payment when you put 3%, 10% or 20% down on a home:

Mortgage down payment decreases monthly payment

It’s really a win, win scenario.

The downside it that you have to come up with 10 – 20% down, but the benefits really outweigh the negatives over the life of the mortgage.

Increasing your down payment gives you negotiating power with the mortgage lender. Why? Because you are actually sharing more of the risk. The more risk that you remove from the eyes of the lender, the lower your interest rate will be.

3 homeowner tips for lower mortgage interest rates

- Asking for lower mortgage interest rate

If you are in really tight times financially and have the financials to back it up, you can call the bank, explain what’s going on and ask to see if they can reduce your interest rate.

Sometimes the lender will lower your interest rate to help you lower your monthly payment and to keep you as a client. Not always, but it never hurts to ask if you are going through a hard time financially and working on ways to lower all bills to get by. Your mortgage could be one of them.

However, if you have been with a mortgage lender for quite a few years and have been paying your loan on-time for years, simply call your bank and ask for a lower interest rate.

Even if you are not going through a tough time financially, you may be able to get a lower interest rate.

If they won’t lower your interest rate, that’s fine, this will then lead us to our next section: Refinancing your mortgage.

- Refinancing

Refinancing your mortgage is a great way to lower your monthly payment and take advantage of lower interest rates.

Yes, you will have to go through filling out ton’s of paperwork and additional lender fees, but if you can save over $100 – $200 per month, its well worth it.

Keep in mind that you will want to recover the costs of the refinance to make it worth it. For instance, if the cost of refinancing your home is $2,000 and your monthly payment is reduced by $100, it will take 20 months to break even.

So, is refinancing worth it then?

A general rule for when to refinance your house is to refinance when your interest rate is lower by over two percentage points.

- 15 Year mortgage

A 15 year mortgage is a fabulous way to reduce the interest rate that you would otherwise pay on a 20 or 30 year mortgage. The other benefits with a 15 year mortgage is that your loan will pay off in half the time AND save you over $100,000 in interest alone.

You read that correct. A 15 year mortgage can save you over $100,000 in interest alone over the lifetime of the mortgage.

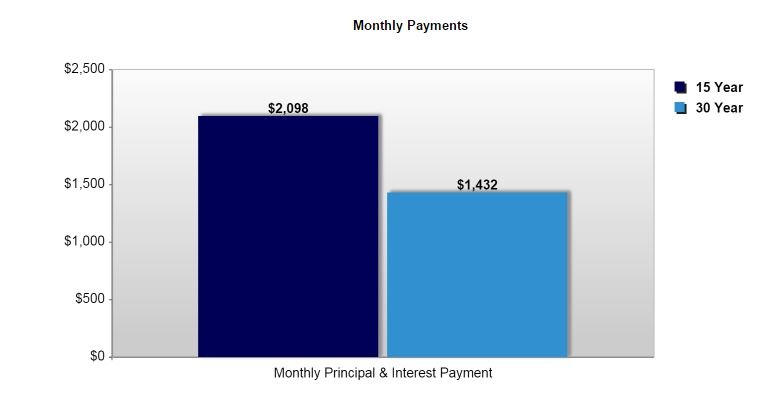

Here are some stats comparing the interest rate of a 15 and 30 year fixed rate mortgage.

The 15 year mortgage on a $300,000 loan, in this example, is $666 more per month.

Monthly payment comparison between 15 and 30 year mortgages

However, 15 year mortgage rates are less than traditional 30 year interest rates. As you can see with the chart below, the 15 year mortgage is almost a full percentage less than the standard 30 year mortgage rate. Your monthly payment is $666 more every month, BUT, you will save over $138,000 over the life of the mortgage in interest alone!!!!!

You read this right. You will save $138,000 in interest alone by going with a 15 year mortgage.

Mortgage loan comparison – 15 vs 30 year

Here is a quick comparison of the principal of each loan from year 0 to year 15.

15 year vs 30 year principle balance comparison

Conclusion

This page is a fabulous resource for the most common ways you can get a lower interest rate on your mortgage. As it applies to both first time home-buyers as well as those who already own a house.

If you are in the market to purchase a new home or refinance your current house, contact us today. We’d love to see how we can save you money and lower your mortgage interest.

Leave a Reply